WORK WITH ME

Interested in working with my firm?

Planable Wealth is a wealth management and tax planning firm that serves retirees and soon-to-be retirees ages 50+.

After thousands of hours of practice, continuing education, and consulting, we have identified that we do our best work with:

- Individuals or Families who have built a net-worth of over one-million dollars (outside of a primary residence) who are either:

- Preparing for or currently in retirement

- Operating a small business

- Trying to figure out what to do with an inheritance from a parent

- Navigating divorce later in life

- Those who simply value being as efficient as possible with their wealth and taxes to keep more of their hard-earned money.

Click here for a small sample of white-glove services our clients currently receive

Begin with a Complimentary Assessment

First, we need to know if we are the right fit to work together.

Believe it or not, financial planners/advisors and tax professionals typically have different specialties - Just as there are pediatricians and there are oncologists, as well as estate attorneys and criminal defense attorneys.

We both need to make sure that your needs match our type of services, so we start with a brief introduction, and build from there:

- It all starts with a brief 15-minute phone call or virtual meeting with one of our team members to get to know you, your most cherished goals, and problems you want solved.

- Next, we schedule a second meeting* that is meant to dive a little deeper on where you currently stand, and to understand other unique aspects of your lifestyle, wants, and needs. We apply our professional insight to help you visualize the beginning steps of your financial game plan or "Big Picture".

*We might ask you to send us certain financial documents in order to provide MASSIVE VALUE to you during this meeting.

Then develop an action plan that will help address:

- Where and how will you get sufficient retirement income to last a lifetime

- Identify if you are paying more than you need to in taxes

- Provide defined goals for each of your investments and strategies to pursue them

- Identify what potential risks threaten your financial goals

- For business owners: An explanation of tax strategies to pursue as well as what options you have to unlock the illiquid wealth tied up in your business

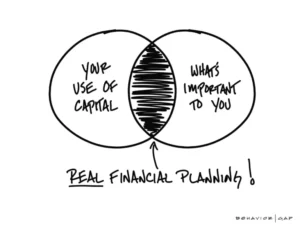

This is where you can start to see the true value financial planning can provide you in dollars and cents.

By the end of the second meeting, we will both be able to determine if we are a good fit to work together moving forward.

Lastly, you decide whether or not you would like us to design, implement, and monitor your action plan with you.

There is never any pressure to work with us. You are the ultimate driver of your financial success.

Tackling financial and tax planning on your own can be daunting and time consuming.

We understand that your time is your most valuable asset, and our role is to help you keep more of it.

Like our style?

Not quite ready yet?

That’s okay! Join our free monthly Retired·ish newsletter for more great content in the meantime.

"*" indicates required fields